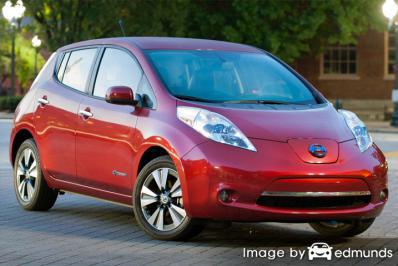

Trying to find the cheapest Nissan Leaf insurance in Oakland? Paying for overpriced Nissan Leaf insurance in Oakland can consume your savings and force you to make tough financial choices. Doing a rate comparison is a smart way to make ends meet.

Trying to find the cheapest Nissan Leaf insurance in Oakland? Paying for overpriced Nissan Leaf insurance in Oakland can consume your savings and force you to make tough financial choices. Doing a rate comparison is a smart way to make ends meet.

Unthinkable but true, the vast majority of car insurance customers in California have remained with the same car insurance company for well over three years, and just under half have never shopped around. Drivers in America can cut their rates by approximately 47% a year, but they just don’t understand how easy it is to find affordable insurance by shopping around.

Lots of auto insurance companies contend for your business, so it’s not easy to compare every company and get the best coverage at the cheapest price on Nissan Leaf insurance in Oakland.

When comparison shopping, there are several ways to compare prices from many available car insurance companies in California. The simplest method to find the lowest Nissan Leaf rates is to get quotes online.

Comparison shopping rates online is easy and it replaces the need to physically go to different Oakland agent offices. The ability to get quotes online reduces the need to sit down with an agent unless you prefer the extra assistance that only an agent can give. If you prefer, some companies allow you to get prices online but purchase the actual policy in an agency. When comparison shopping, comparing all the rates in your area helps locate a better price.

The providers in the list below have been selected to offer quotes in Oakland, CA. To find the best auto insurance in Oakland, it’s highly recommended you get prices from several of them in order to get a fair rate comparison.

Insurance protects more than just your car

Even though Oakland Leaf insurance rates can get expensive, insurance is required in California but also provides important benefits.

- The majority of states have minimum liability requirements which means the state requires a minimum amount of liability if you want to drive legally. In California these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

- If you have a lien on your vehicle, more than likely the lender will make it a condition of the loan that you have insurance to guarantee payment of the loan. If you default on your policy, the bank may insure your Nissan for a much higher rate and make you pay a much higher amount than you were paying before.

- Insurance protects both your assets and your Nissan Leaf. It will also cover medical bills incurred in an accident. Liability insurance, one of your policy coverages, also pays expenses related to your legal defense if anyone sues you for causing an accident. If damage is caused by hail or an accident, your policy will cover the damage repairs after a deductible is paid.

The benefits of insuring your Leaf greatly outweigh the cost, especially for larger claims. Today the average American driver overpays more than $855 a year so we recommend shopping around at least once a year to be sure current rates are still competitive.

Don’t overlook these six Nissan Leaf insurance discounts

The cost of insuring your cars can be expensive, but there are discounts available that you may not even be aware of. Certain reductions will be credited at the time of quoting, but lesser-known reductions have to be inquired about prior to receiving the credit.

- Resident Student – Any of your kids who attend college more than 100 miles from Oakland and don’t have a car could get you a discount.

- Student Driver Training – Reduce the cost of insurance for teen drivers by having them successfully complete driver’s ed class as it can save substantially.

- Own a Home and Save – Just owning your own home can earn you a little savings due to the fact that maintaining a home demonstrates responsibility.

- Multi-Vehicle Discounts – Buying insurance for more than one vehicle on one policy can get a discount for every vehicle.

- Discounts for Good Drivers – Drivers who avoid accidents can pay as much as 50% less as compared to drivers with claims.

- Good Students Pay Less – A discount for being a good student can get you a discount of up to 25%. This discount can apply up until you turn 25.

A quick disclaimer, most of the big mark downs will not be given to the overall cost of the policy. Most only cut specific coverage prices like comp or med pay. Just because you may think you would end up receiving a 100% discount, it just doesn’t work that way.

To choose providers offering insurance discounts in California, click here.

Local insurance agents

A lot of people still prefer to buy from a licensed agent. An additional benefit of comparing rates online is the fact that drivers can get lower car insurance rates and still have a local agent.

To find an agent, once you fill out this short form, the coverage information is sent to agents in your area who will gladly provide quotes for your coverage. It makes it easy because there is no need to contact any agents since rate quotes are delivered instantly to you. Get lower rates without the usual hassles of price shopping. If you need to get a comparison quote from a particular provider, you just need to go to their quote page and fill out the quote form the provide.

To find an agent, once you fill out this short form, the coverage information is sent to agents in your area who will gladly provide quotes for your coverage. It makes it easy because there is no need to contact any agents since rate quotes are delivered instantly to you. Get lower rates without the usual hassles of price shopping. If you need to get a comparison quote from a particular provider, you just need to go to their quote page and fill out the quote form the provide.

Deciding on a insurer should include more criteria than just a cheap price. Here are some questions you should ask.

- What companies can they write with?

- Are they involved in claim handling?

- Which family members are covered?

- Are they full-time agents?

- Does the agency have a current Errors and Omissions policy?

Best car insurance company in California

Ending up with the right car insurance provider can be challenging considering how many different insurance companies sell coverage in California. The ranking data listed below could help you choose which auto insurers you want to consider buying from.

Top 10 Oakland Car Insurance Companies Overall

- USAA

- American Family

- AAA of Southern California

- State Farm

- The Hartford

- AAA Insurance

- GEICO

- The General

- Titan Insurance

- Progressive

Auto insurance 101

Knowing the specifics of your policy aids in choosing appropriate coverage for your vehicles. The terms used in a policy can be confusing and coverage can change by endorsement. Shown next are the normal coverages offered by insurance companies.

Insurance for medical payments

Personal Injury Protection (PIP) and medical payments coverage pay for expenses for things like dental work, rehabilitation expenses, funeral costs and EMT expenses. They are used to fill the gap from your health insurance program or if you are not covered by health insurance. Medical payments and PIP cover both the driver and occupants and will also cover if you are hit as a while walking down the street. PIP is not available in all states but can be used in place of medical payments coverage

Collision coverage

Collision insurance will pay to fix damage to your Leaf resulting from colliding with another vehicle or an object, but not an animal. You will need to pay your deductible then the remaining damage will be paid by your insurance company.

Collision can pay for things like backing into a parked car, hitting a parking meter, sustaining damage from a pot hole, crashing into a building and crashing into a ditch. Collision coverage makes up a good portion of your premium, so consider dropping it from older vehicles. It’s also possible to bump up the deductible on your Leaf to bring the cost down.

Coverage for liability

Liability insurance protects you from injuries or damage you cause to other people or property that is your fault. This coverage protects you against claims from other people. It does not cover damage to your own property or vehicle.

It consists of three limits, per person bodily injury, per accident bodily injury, and a property damage limit. You might see values of 15/30/5 that translate to $15,000 bodily injury coverage, a limit of $30,000 in injury protection per accident, and a total limit of $5,000 for damage to vehicles and property.

Liability coverage protects against claims like medical expenses, repair bills for other people’s vehicles, court costs and emergency aid. How much liability coverage do you need? That is your choice, but consider buying as large an amount as possible. California requires drivers to carry at least 15/30/5 but drivers should carry more coverage.

The next chart shows why buying minimum limits may not be adequate coverage.

Comprehensive coverage (or Other than Collision)

Comprehensive insurance coverage will pay to fix damage from a wide range of events other than collision. You first must pay your deductible and then insurance will cover the rest of the damage.

Comprehensive can pay for claims such as a tree branch falling on your vehicle, hitting a deer, falling objects and theft. The most you can receive from a comprehensive claim is the market value of your vehicle, so if it’s not worth much more than your deductible it’s not worth carrying full coverage.

Uninsured Motorist or Underinsured Motorist insurance

This provides protection when other motorists are uninsured or don’t have enough coverage. Covered claims include injuries sustained by your vehicle’s occupants as well as damage to your Nissan Leaf.

Because many people only carry the minimum required liability limits (California limits are 15/30/5), it only takes a small accident to exceed their coverage. This is the reason having UM/UIM coverage should not be overlooked.

One last thing to lower rates

When searching for affordable Nissan Leaf insurance quotes, it’s not a good idea to skimp on critical coverages to save a buck or two. In many instances, someone sacrificed uninsured motorist or liability limits only to find out that saving that couple of dollars actually costed them tens of thousands. Your strategy should be to buy a smart amount of coverage at the best possible price, but do not skimp to save money.

We just showed you a lot of ways to reduce Nissan Leaf insurance prices online in Oakland. The most important thing to understand is the more rate comparisons you have, the higher the chance of saving money. Drivers may even discover the best price on car insurance is with some of the lesser-known companies. Some small companies can often provide lower rates in certain areas than their larger competitors like State Farm and Allstate.

Budget-conscious Nissan Leaf insurance can be sourced online in addition to local insurance agencies, and you need to price shop both in order to have the best chance of saving money. Some companies do not offer internet price quotes and these regional insurance providers only sell through independent agents.

How to find the cheapest rates for Nissan Leaf insurance in Oakland

It takes a few minutes, but the best way to get cheaper Nissan Leaf insurance in Oakland is to begin comparing prices regularly from providers who sell insurance in California. Rate comparisons can be done by following these guidelines.

First, try to understand how insurance companies determine prices and the things you can control to lower rates. Many factors that drive up the price such as traffic tickets, fender benders, and a low credit score can be amended by making small lifestyle or driving habit changes.

Second, request rate estimates from direct carriers, independent agents, and exclusive agents. Direct and exclusive agents can only provide price estimates from a single company like Progressive and State Farm, while independent agencies can give you price quotes from multiple insurance companies.

Third, compare the new rates to the premium of your current policy and determine if cheaper Leaf coverage is available in Oakland. If you can save money, ensure coverage does not lapse between policies.

Fourth, tell your current company to cancel the current policy. Submit payment and a signed application to the newly selected company. As soon as coverage is bound, put the new certificate of insurance in a readily accessible location in your vehicle.

A valuable tip to remember is to make sure you’re comparing identical coverage information on each price quote and and to get rate quotes from all possible companies. Doing this enables a level playing field and many rates to choose from.

To learn more, feel free to visit the following helpful articles:

- What is a Telematics Device? (Allstate)

- Who Has Cheap Auto Insurance for a Subaru Outback in Oakland? (FAQ)

- What is Full Coverage? (Allstate)

- No-Fault Auto Insurance Statistics (Insurance Information Institute)

- Five Tips to Save on Auto Insurance (Insurance Information Institute)

- Protecting Teens from Drunk Driving (Insurance Information Institute)